New Report: CRE Sentiment Declines Amid Growing Caution

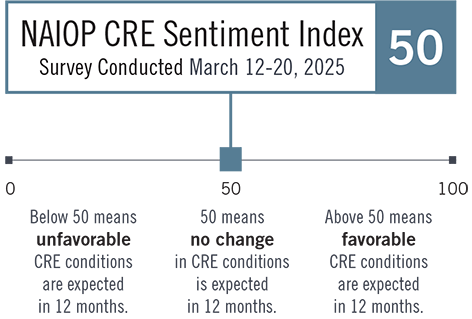

The NAIOP CRE Sentiment Index, which measures industry expectations for commercial real estate market conditions over the next 12 months, has dropped to 50 – down from 56 in September 2024. This decline suggests a more cautious outlook across the industry.

It's worth noting that the survey was conducted in mid-March, before the Trump administration announced new tariffs on nearly all U.S. imports, a move that could further influence industry sentiment.

Key Findings:

- Respondents expect transaction volumes to increase at nearly the same rate (score of 57) as in the September 2024 survey (score of 58).

- Open-ended comments suggest more deal volume will be concentrated in existing buildings than in ground-up development. Not everyone is deploying capital, however, and several respondents indicated in comments that they are waiting on the sidelines due to uncertainty about the direction of the economy.

- Respondents expect construction material and labor costs to rise sharply over the next 12 months.

- Respondents are slightly more optimistic about occupancy rates and rents than they were in September 2024.

- They are somewhat less optimistic about capital market conditions, including the availability of debt and equity.

- Most respondents expect to be most active in industrial or multifamily real estate during the next 12 months.

View archived blog posts at: http://naiopcharlotte.wordpress.com