Posted on July 15, 2019

Beginning July 1, the Town of Huntersville is assuming review of all land development review and permitting, bringing in-house a variety of services previously provided by Mecklenburg County.

But because the Town failed to request delegated authority for Erosion & Sedimentation Control from the North Carolina Department of Environmental Quality (DEQ), all E&S review and inspections for projects in Huntersville will continue to be provided by Mecklenburg County LUESA until at least mid-August.

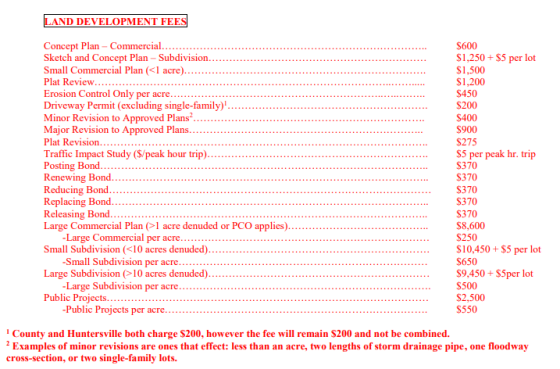

All development plans previously submitted to LUESA will continue to be reviewed by the County, which will also conduct inspections on those projects. Any new development projects submitting from today forward will go through the Town’s Engineering & Public Works Department. Huntersville last month adopted a new fee schedule that is similar to the 2018 LUESA fees for land development plan review, bond maintenance and other related services.

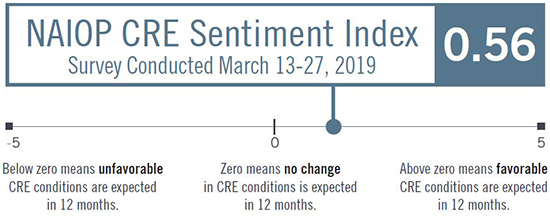

The City of Charlotte is considering revisions to its Minimum Housing Code Ordinance, with changes that could impact housing affordability by raising the cost of property management and code compliance for landlords.

The City of Charlotte is considering revisions to its Minimum Housing Code Ordinance, with changes that could impact housing affordability by raising the cost of property management and code compliance for landlords.